Collaboration & Cooperation. Let’s begin, Let’s take action.

WIDA Investment Analysis # 1

The State of Global FDI and Potential Areas for Collaboration

This investment analysis article was jointly developed by founding organizations for the launch of the World Investment for Development Alliance (WIDA), in Davos, on 23 May 2022. [1]

These points are not aimed to be definitive or comprehensive, but rather to stimulate further discussion, and potential action.

Introduction

At the launch of the World Investment for Development Alliance (WIDA), this note aims to briefly present the state of global foreign direct investment (FDI) and its challenges, and outline ideas on potential areas of action.

Background

FDI recovered strongly in 2021 after a major plunge in 2020, when flows slumped due to the lockdowns and shocks associated with the COVID-19 pandemic. However, the recovery has been highly uneven, with flows to developed countries recovering rapidly while those to developing countries, and particularly Least Developed Countries (LDCs), witnessed a slow recovery marked by growing internal disparities. [2] Furthermore, much of the rebound in global FDI came from reinvested earnings, with equity flows – often seen as a better measure of new investments – still 3% below pre-pandemic levels. [3]

Investments that are taking place are not sufficiently going to projects that can help advance sustainable development. Greenfield investment in industry and new infrastructure investment projects in developing countries were hit particularly hard during the pandemic. This is a major concern, because international investment flows are vital for sustainable development in the poorer regions of the world. [4] Policy-makers in these countries face public budgetary constraints coupled with debt ceilings on one side and narrow capital markets on the other, which makes it especially challenging for them to advance sustainable infrastructure. [5]

The war in Ukraine and further COVID-19 lockdowns in China will likely create headwinds to the rebound in FDI flows that began in 2021. The global rise in fuel prices may reverse the sharp increase recently seen in FDI in renewables as a share of total energy sector FDI, as fossil fuels stage a short-term recovery. As a result of these challenging global conditions, global FDI flows will probably continue to remain well below their peak in 2007, as calculated as a share of global GDP.

Such challenges, together with a still uneven global vaccination roll-out, fractured supply chains and lack of consistent policies to stimulate private investment may continue to hamper recovery in developing countries. [6] This is aggravated by the limited diffusion of new technologies and digitalization. The top 100 digital multinational enterprises (MNEs) remain highly concentrated geographically. Although several of the new entrants in this ranking have their headquarters in developing countries, the list is still dominated by firms from developed economies, mostly from the United States (59) and Europe (22). [7] Only a few digital MNEs from Southeast Asia and Latin America are gaining global prominence.

Looking forward – Ideas for future action

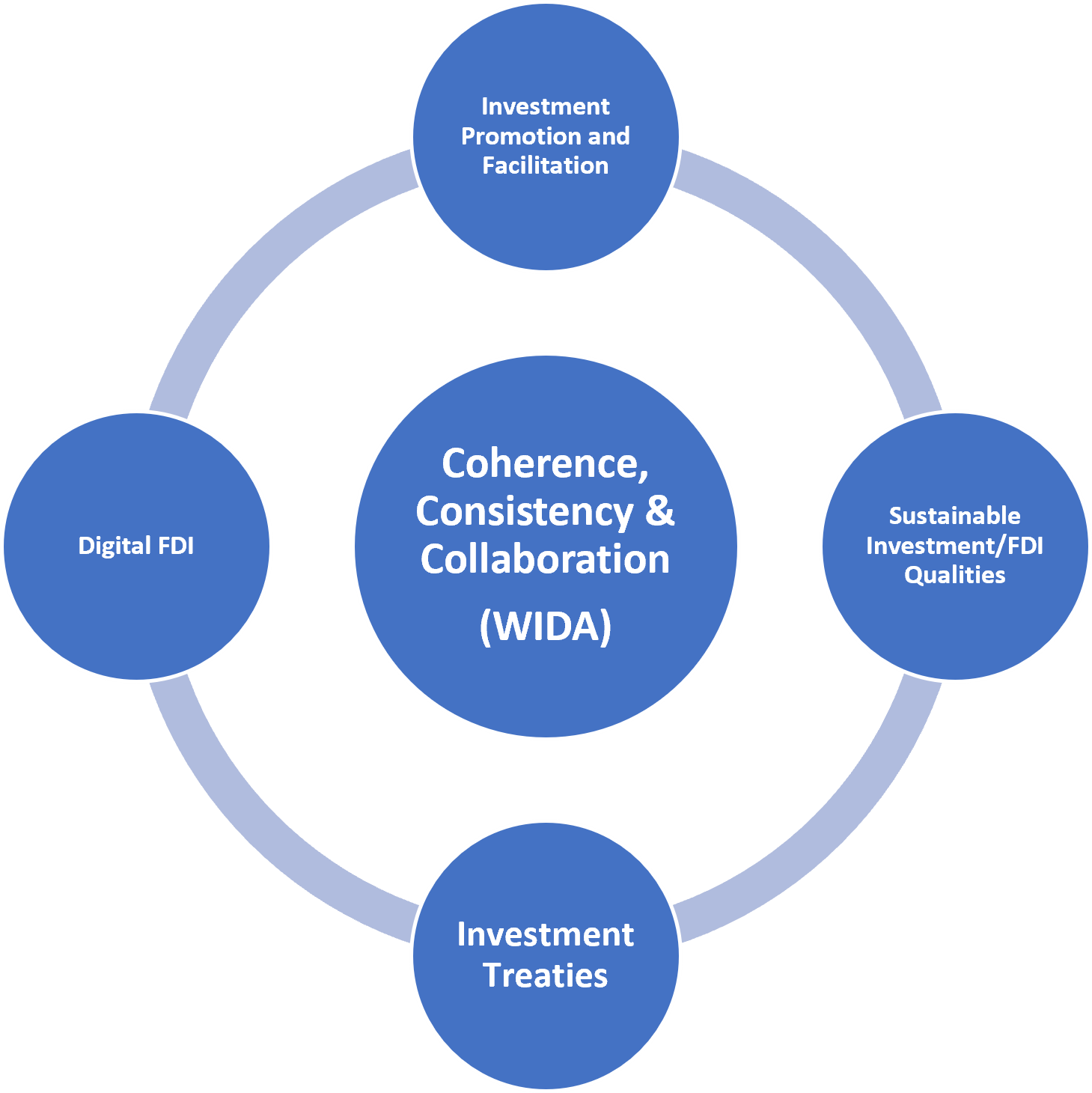

Fully understanding and addressing the causes of the secular decline in FDI flows and the link between international investment and sustainable development are key challenges for policymakers, not least investment promotion agencies (IPAs). This calls for better understanding of potential actions to help address these challenges, categorized by WIDA as follows to organize collaboration on investment policy and practice.

These points are not aimed to be definitive or comprehensive, but rather to stimulate further discussion, and potential action:

Click the title below to view full text

-

This is a critical time for FDI and for IPAs, as countries seek creative ways to expand and retain investment. As firms and governments seek to build resilience, adapting to changing economic and political conditions, IPAs will look to attract investment in areas such as health, the green economy, new technologies, or driven by a reconfiguration of global or regional value chains. Targeted promotion and facilitation efforts can also help increase FDI flows that grow innovation, skills, and gender equality.

The most recent joint WAIPA-World Bank Global Survey on the State of Investment Promotion Agencies shows that the sustainable development goals (SDGs) and the promotion of the SDGs has become increasingly important for IPAs. As the sustainability imperative as well as green goals offer new investment opportunities, IPAs can play an important role in facilitating such opportunities, including through policy advocacy. [8]

Such advocacy can help create a whole-of-government approach to ensure the right enablers for investments. IPAs also have an important role to play in helping and supporting investors’ decision-making, which can lead to new and innovative forms of investment. Regional initiatives to promote greater integration, such as the African Continental Free Trade Area Agreement and the planned Investment Protocol, will also be important to help grow investment flows. [9]

Additionally, the linkages of investment promotion and facilitation initiatives and measures with the broader economy and especially between lead firms and other domestic players, such as micro, small and medium-sized enterprises (MSMEs), have potential to generate SDG gains and need better assessment.

-

Going beyond the secular decline in the quantity of FDI, the quality of FDI is also fundamental. Home and host governments are increasingly concerned with the impact of FDI on sustainable development. Investment that is sustainable from an environmental, social and governance perspective is crucial for FDI to generate actual benefits for people and planet, providing not only capital but also helping to alleviate poverty, create jobs, accelerate the energy transition, and develop much-needed inclusive infrastructure to provide goods and services for all.

The evidence shows that the investment activities of foreign firms generate greater increases in domestic productivity relative to investment activities of local firms, while also paying higher wages [10] and offering women greater opportunities. [11] Yet, as the OECD FDI Qualities Indicators reveal, the sustainable development benefits of FDI are not uniform, with some countries benefiting more than others, and within countries, some segments of the population again benefiting more than others. [12] Impacts can also differ across different SDGs as some sustainability objectives are mutually reinforcing while others may necessitate trade-offs.

Understanding these trade-offs and the role of policies in bringing about sustainable outcomes is thus essential. This will help leverage investment to contribute to addressing the multiple sustainability challenges that the world is currently facing, such as climate change, conflict, pollution, hunger, and poverty, while contributing to the protection of the environment and the promotion of fair and inclusive development.

-

Reform of the international investment regime can help shift investment towards inclusive and sustainable development. Despite its potential, much of the legal framework governing foreign investments was designed in another era and does not necessarily reflect today’s priorities.

Certain challenges posed by existing legal tools, including investment treaties, laws and contracts —as well as the process for resolving investment disputes — have become more apparent over time. The need for international investment agreement reform is now recognized and being advanced across various platforms.

-

The growing importance of the digital economy opens up new opportunities for investment-led sustainable development through digital FDI: cross-border investment in the digital economy. Digital FDI can help boost competitiveness, increase entrepreneurial activity, and grow participation in global value chains. Digital firms have shown tremendous growth in the last decade, further accelerated by the pandemic. Building on firm-specific advantages in intangibles, network effects and digital assets, such firms can reach scale in a short time and expand abroad rapidly. They are transforming not only traditional industries but also forms of international production through a reconfiguration of value chains. As such, the global expansion of digital firms and their related investments is highly relevant for the development strategies of host economies. [13]

At the same time, certain types of digital FDI can be asset-light and therefore may have limited direct infrastructure and job creation effects in host economies, even while the dynamic growth it generates can create second-order employment effects. In addition, as the digital economy is a relatively new area, there are information gaps and coordination challenges to connecting capital to digital investment opportunities, particularly in developing economies. Regulatory frameworks may also be outdated and not foster “digital friendly” investment climates. For all these reasons, there is a need to work on identifying and adopting policies, regulations and measures that can help attract and facilitate FDI in the digital economy. [14] At the same time, the implications for the innovation ecosystem, including start-ups, certainly exist and need to be assessed together with the related regulatory challenges.

-

There should be coherence and consistency across different processes and institutions related to investment. Many investment reform processes are disconnected from each other, as well as from related processes taking place in other policy forums, such as those regulating the environment, public health, or human rights. Similarly, negotiations taking place at the international level are not always aligned with relevant domestic initiatives and laws. At present, we are at risk of introducing reforms in one area or policy sphere that jeopardize or are orthogonal to reforms undertaken in others. The challenge is thus to develop a shared, coherent vision for international investment governance, under which different investment reform processes and initiatives can be aligned and mutually supportive.

Successful reform requires an ambitious, collaborative approach. For reform efforts to have a tangible impact, there is a need to find innovative ways to spur investment into priority areas and initiatives. Success will therefore require a wide range of stakeholders to come together to join forces to support and advance this important goal.

For all these reasons, WIDA can play an important role in fostering deeper cooperation and delivering joint activities based on shared ideas and priorities. Future activities can take various forms, including information sharing, dialogue, outreach, and projects.

WIDA is starting the conversation.

Join us & let’s build together.

- This article presents a collective effort of the staff of WIDA organizations. It does not represent the official position of the individual member organizations, nor implies any legal effect on the rights and obligations of the members states of those organizations.

- Global Investment Trend Monitor n. 40, January 2022, UNCTAD.

- FDI in Figures, April 2022, OECD.

- World Investment Report 2021: INVESTING IN SUSTAINABLE RECOVERY, April 2021, UNCTAD.

- Credit Enhancement for Sustainable Infrastructure, October 2018, IISD.

- World Bank Group Annual Report 2021: From crisis to green, resilient and inclusive recovery, October 2021, WBG.

- Global Investment Trends Monitor, n. 41, April 2022, UNCTAD.

- WAIPA-World Bank Global Survey on the State of Investment Promotion Agencies, 2020, WAIPA and WBG.

- The African Continental Free Trade Area, 2018, African Union.

- FDI effects on the labor market of host countries, September 2016, FED; and Labor Markets and the Demand for Foreign Direct Investment, Cambridge University Press, 2010.

- Foreign Direct Investment and Women Empowerment: New Evidence on Developing Countries, January 2018, IMF; and

- Gender spillovers in foreign direct investments: An analysis of Namibia, May 2022, Thunderbird International Business Review.

- FDI Qualities Indicators, October 2019, OECD.

- Global Investment Trends Monitor, n. 41, April 2022, UNCTAD.

- Digital FDI Policies, regulations and measures to attract FDI in the digital economy, September 2020, WEF.